Buy art on leasing

Artworks lease for businesses and liberal professions

What is leasing art?

Purchase of art through leasing offers businesses enhanced financial flexibility and potential tax advantages

A lease-purchase agreement allows you to finance the work over 13 to 60 months while lowering your corporate tax through monthly payment deductions from taxable income. Note: the 14-day cooling-off period does not apply to lease-purchase agreements.

Art Purchase through Leasing: Simulate Your Financing

Leasing works of art offers several significant advantages for businesses and liberal professions, including:

Tax Deduction: Rents paid as part of leasing are 100% deductible from operating income, which reduces corporate tax (IS) for businesses or personal income tax (IRPP) for liberal professions.

Spreading Costs: The cost of acquiring the work can be spread over a period of 13 to 60 months, which helps preserve the company’s cash flow.

Conservation of Borrowing Capacity: Leasing is considered as a rental expense, and not as a purchase, thus allowing companies to maintain their borrowing capacity from financial institutions.

Advantageous Purchase Option: At the end of the leasing contract, companies have the option of purchasing the work of art for a generally low residual value (around 5% of its initial value).

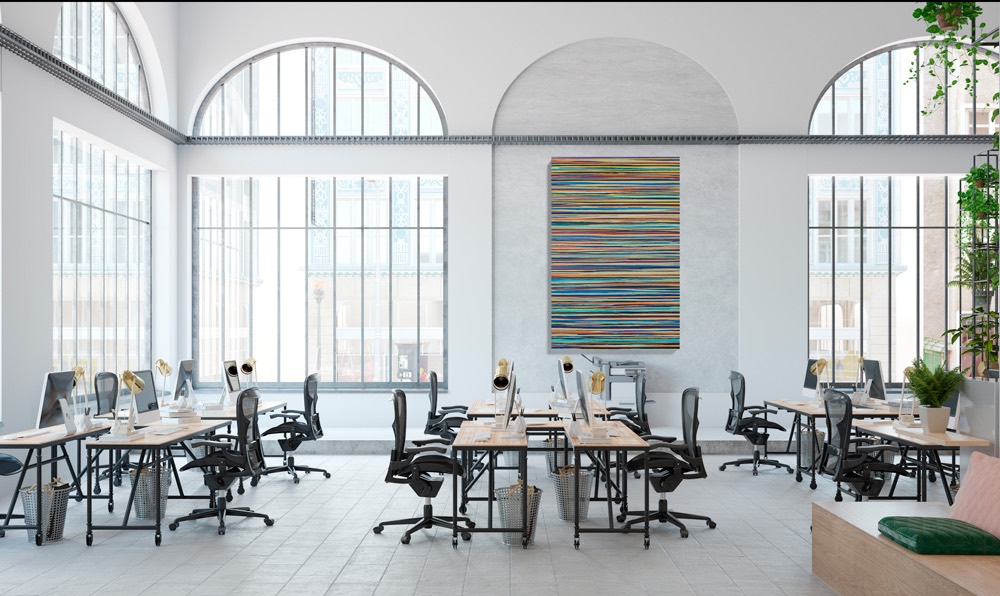

Enhancement of the Company’s Image: Integrating works of art into professional premises can improve the company’s image and create a more stimulating and culturally enriching work environment.

This financing option, in addition to supporting artistic creation, encourages companies to disseminate values of creativity and openness.

Leasing information request

Frequently Asked Questions

What is artwork leasing at Artmajeur?

Art leasing at Artmajeur is a service that allows you to rent works of art for a specific period. You can therefore enjoy the work at home or in your business, without purchasing it immediately.

Why is art leasing only aimed at businesses and liberal professions?

In fact, only businesses and liberal professions (doctors, lawyers, accountants, architects, engineers, liberal nurses, physiotherapists, pharmacists, midwives, veterinarians, etc.) can benefit from art leasing in France, mainly because of the specific tax and accounting advantages they can derive from the depreciation of works of art acquired in this way.

Can we change the rented work before the end of the leasing contract?

No, once you have chosen a work and signed the leasing contract, you cannot change your work before the end of the contract.

Is it possible to cancel a leasing contract before its end?

No, leasing contracts must be honored until their end. It is not possible to cancel a contract before the end of the agreed period.

Who is responsible for insuring the artwork during the leasing period?

The customer is responsible for insuring the artwork for the duration of the leasing contract. It is important to ensure that the work is covered in the event of damage or loss.

What happens at the end of the leasing contract?

At the end of the contract, the company has the possibility of acquiring the work by paying only its residual value, that is to say the amount remaining to be paid. to become owner of the work.

Can we pay an increased first rent? What are the advantages ?

Yes, it is possible to pay an initial increased rent in the first year. This option may offer tax benefits, such as tax reductions from the first year, depending on your tax situation and current laws.

What types of works and from which artists are the works of art available for leasing?

Artmajeur offers a wide selection of artworks from different styles and artists. You can choose the one that best suits your taste and space.